How Covid-19 pandemic will shape the real estate industry?

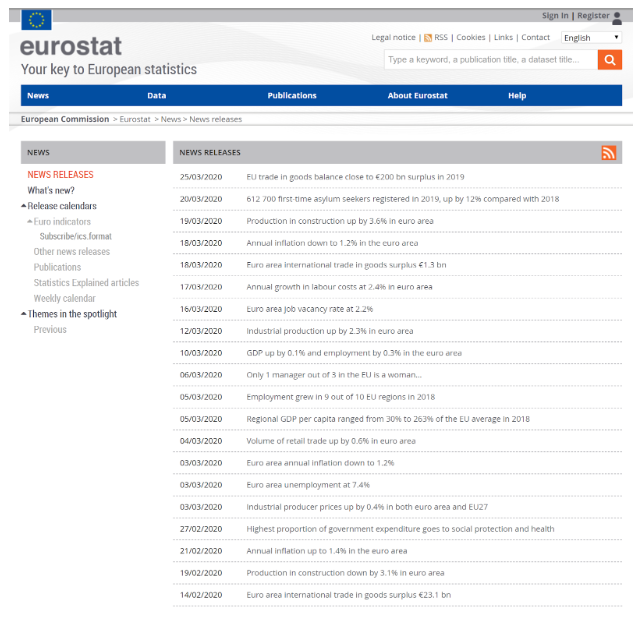

Development of residential projects in Riga, Latvia will be the best real estate investment in 2020. This is based on my assumption that there will be a significant decline in construction costs. We already see around 50% decline in crude oil (Brent) price1 in last 30 days which I use as an indicator to forecast an overall global demand decline (unfortunately no relevant statistics data have been presented by Eurostat2 since Covid-19 outbreak in European Union to challenge this assumption).

Construction costs make up 50-80% of the total costs of an average residential development project in Riga (as a comparison, construction costs make up 20-40% of total costs of an average residential project in Barcelona). Assuming that the demand for construction services (both private and public) will drop significantly, a major decline in both labor costs and material costs can be expected. It should also be kept in mind that real estate investments are usually long term investments, and demand for high-quality residential space at the end of 2020 and during 2021 should remain stable.

Combine the aforementioned statement with an honest opinion on the real estate industry for a forecast on how the COVID-19 pandemic will affect investors during the expected economic recession.

INVESTMENT FUNDS AND REAL ESTATE INVESTMENT FIRMS

I expect significant negative short-term impact to the value of portfolios of investment funds and real estate investment firms as they mainly consist of commercial real estate (retail, office, logistics).

These negative short-term effects are due to economic downturn and the consequent challenges that such investment firms will face – a decline of expected revenue and net operating income (NOI). The acquisition prices of assets included in the previously mentioned portfolios were fixed during transactions that occurred before the Covid-19 pandemic, and the expected NOI didn’t factor in the pandemic and the economic recession. Retail and logistics assets (hotels, without a doubt) will suffer the most as their revenue stream has a direct correlation with Covid-19. Because retailers are closing down their stores and logistics industries are experiencing disruptions in the supply chain, tenants’ cash flow shall be significantly impacted. Office assets will be affected with a few months’ delay, as their revenue streams will be affected by the solvency of their tenants, which will result in more flexible terms by landlords and a consequent decline of net operating income.

Thousands of Nasdaq Baltic and Nasdaq Nordic stock exchange investors have voted with their money in favor of such a forecast. Stock prices of major real estate funds and firms operating in the Baltic states have dropped significantly in the last 3 weeks:

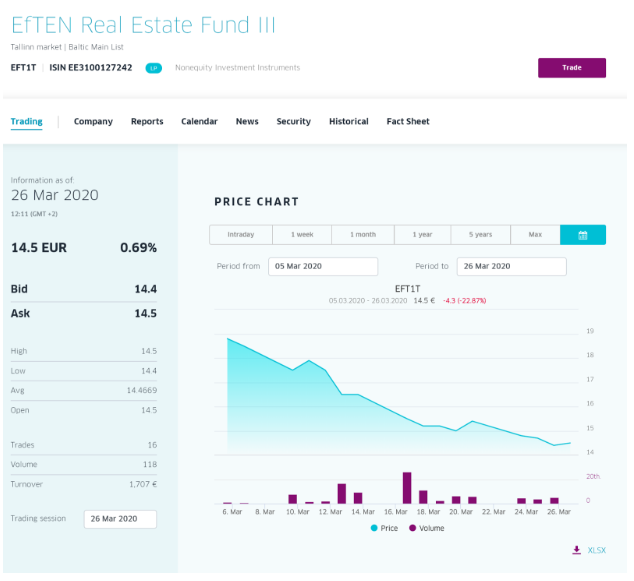

- EfTEN Real Estate Fund III3 (NAV 71 MEUR before expected merger) share dropped by 23%

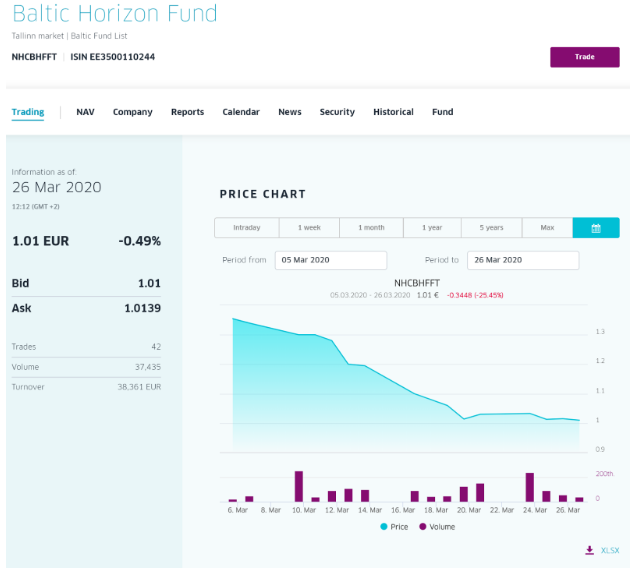

- Baltic Horizon Fund4 (NAV 151 MEUR) share dropped by 25%

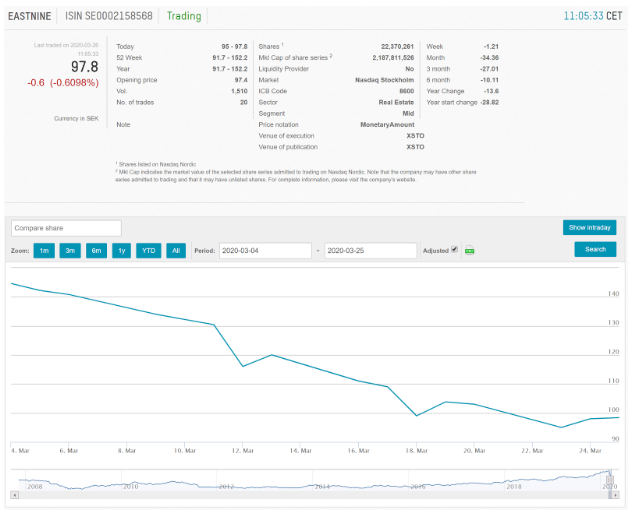

- Eastnine5 (NAV 249 MEUR) share dropped by 32%

REAL ESTATE BROKERS, VALUATORS, MARKETING FIRMS

I have compassion towards the local real estate ecosystem’s most active players – brokerage firms, valuators, marketing service providers. In my mind they will take the biggest hit because of two general reasons: first, their business has already stopped due to restrictive measures taken by the government and, second, their pockets are not as deep as those of investment firms or construction companies. I expect that a lot of companies will close their doors forever, leaving behind a lonely website as the only mark of their existence.

CONSTRUCTION COMPANIES, CONSTRUCTION MATERIAL MANUFACTURERS AND DISTRIBUTORS

These will be very challenging times for construction companies and construction material manufacturers and distributors. The demand for construction services and materials will decline gradually as they will be affected mostly by canceled or frozen investment projects, both public and private. Government funds will be directed mainly towards medical infrastructure and to stabilizing the economy (unemployment benefits, tax holidays, credit guarantees and other fiscal tools). The ability of the public sector to organize construction procurement procedures will also be limited.

Due to current uncertainty, I assume that banks will not issue new investment loans until the scope of the recession is determined. This will freeze most private investment projects for the next 9-12 months. Large proportions of construction materials are produced locally, therefore it is expected that construction material prices will decline. Labor costs will be affected even more as there are thousands of unemployed construction workers in the market. Construction material distribution companies will face two challenges simultaneously: the lack of demand and problems with supply chains.

I should also mention that banks will also experience significant challenges, but this is a complex topic to explore in a separate article. Nevertheless, the point to be taken is – real estate holds value much better than any other asset class. It is a limited resource and demand for residential space is determined by the amount of residents in the city.

Taking into account all factors mentioned above, I strongly believe it is the right time to invest in residential projects.

In response to the Covid-19 crisis, on March 19 we launched a new offering to TWINO investment platform investors called TWINO Ventures, that makes it possible to diversify their existing portfolios with secured loans in real estate projects. The loans will see TWINO’s investors provide funding for real estate projects. The projects are carefully selected by our real estate team, working alongside TWINO’s investment experts that are led by myself and founder and former CEO, Armands Broks. Real estate marks the first investment opportunity from TWINO Ventures, with additional offerings likely to be included in the coming years. TWINO plans to invest more than €30 million through TWINO Ventures in 2020 and to triple this amount by 2022.

1Crude Oil (Brent) price chart in last 30 days (https://markets.businessinsider.com/commodities/oil-price?type=brent):

2Recent news releases by Eurostat (https://ec.europa.eu/eurostat/news/news-releases):

3EfTEN Real Estate Fund III share price at Nasdaq Baltic (https://www.nasdaqbaltic.com/statistics/en/instrument/EE3100127242/trading?date=2020-03-18):

4Baltic Horizon Fund share price at Nasdaq Baltic (https://www.nasdaqbaltic.com/statistics/en/instrument/EE3500110244/price?date=2020-03-18):

5Eastnine share price at Nasdaq Nordic (http://www.nasdaqomxnordic.com/aktier/microsite?Instrument=SSE49615):