We hope this message finds you well. Here’s the latest update on TWINO activities and platform performance.

New Suitability and Appropriateness assessment. We have launched a new Suitability and Appropriateness (S&A) assessment. With this update, we have implemented changes to better align your investment decisions with your risk appetite and tolerance, ensuring that your portfolio supports your financial goals. Measures have been implemented to safeguard your interests by carefully reviewing and adjusting Auto-Invest limits and methodologies, as well as offer you increased freedom and flexibility when it comes to manual investments. You can fill out the new assessment from the “Suitability & Appropriateness assessment” tab under “Account status” of your TWINO profile

TWINO x Finfellas Riga 2023 in review. At the very beginning of June, we participated in Finfellas Riga 2023 conference where we together with conference organizers and industry peers brought the latest content on fintech, investing, peer-to-peer lending, and many other topics. Given the industry’s regulation, which introduces new requirements and benefits that investors and investment platforms are still assimilating and implementing, we believe that this year held even greater significance for facilitating those discussions and bringing them to the forefront.

We highly appreciate the opportunity to connect with investors and industry representatives, foster transparent conversations, and together strive for an industry that is both secure, amicable, and fosters innovation.

TWINO CEO Helvijs Henšelis took the stage to participate in a panel discussion that offered an overview of various investment products including what we offer on TWINO. Key takeaways:

- Unlike many other investments, investments in loan securities are accessible to anyone and require a little initial investment amount while offering the benefits of investing in a fully regulated environment

- Loan securities are an attractive asset class for investors looking for investments with higher return opportunities

- When it comes to creating a diversified investment portfolio, loan securities have proven to be valuable portfolio addition

- Loan securities typically exhibit different market behavior compared to traditional investments like stocks and bonds. When the stock market experience declines, loans are less likely to be influenced by the same triggers

- Loan securities are the asset class that is contributing to financial inclusion in emerging markets across the world

- Like any other type of investment, loan securities are not exempt from investment risk, so it’s important for investors to consider their risk appetite and investment goals

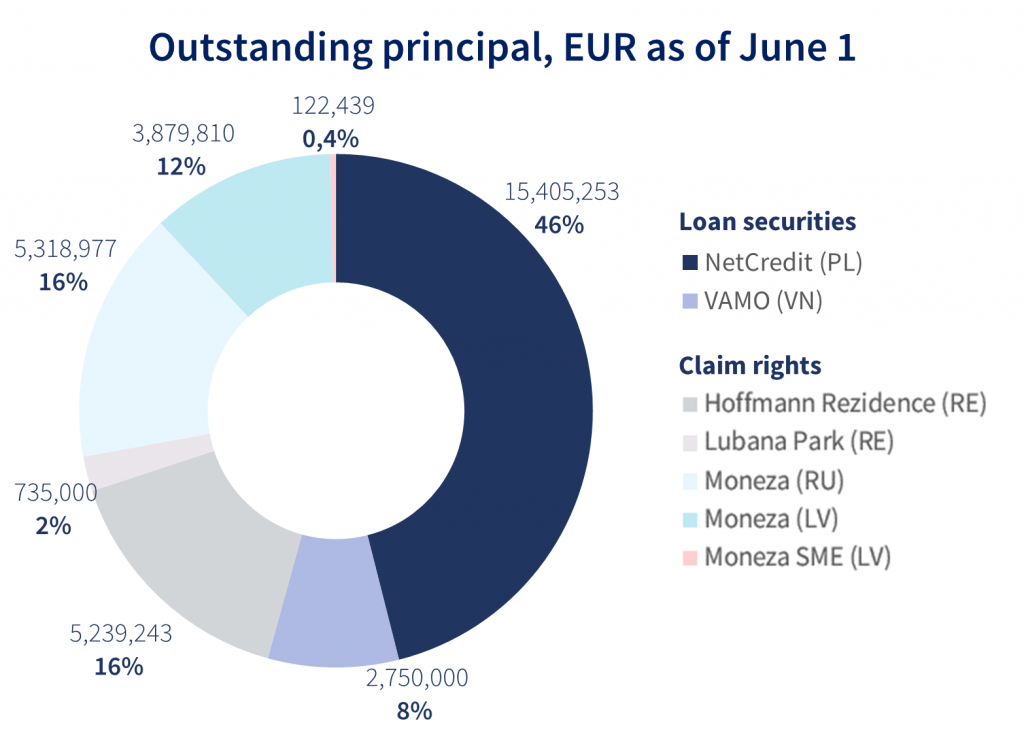

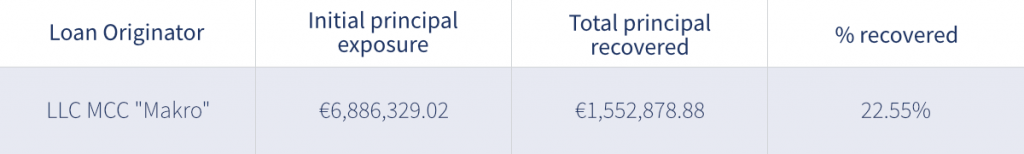

Update on Russian loans. Please see the latest summary of war-affected loans below:

As of today, over €1.5 million of war-affected loans have already been repaid. Meanwhile, you continue to receive interest on the full outstanding principal amount.

TWINO customer support working hours this week. Please note that on the 23rd of June, our customer support team will not be available due to Midsummer Holiday in Latvia. However, feel free to reach out to us during this time, and we will respond promptly on the following working days, starting from the 26th of June.

There will also be a delay in payment processing. Please plan your funding and withdrawal transactions accordingly. TWINO platform will remain fully accessible throughout the holidays.