We’re reaching out to share the latest TWINO news and platform performance insights.

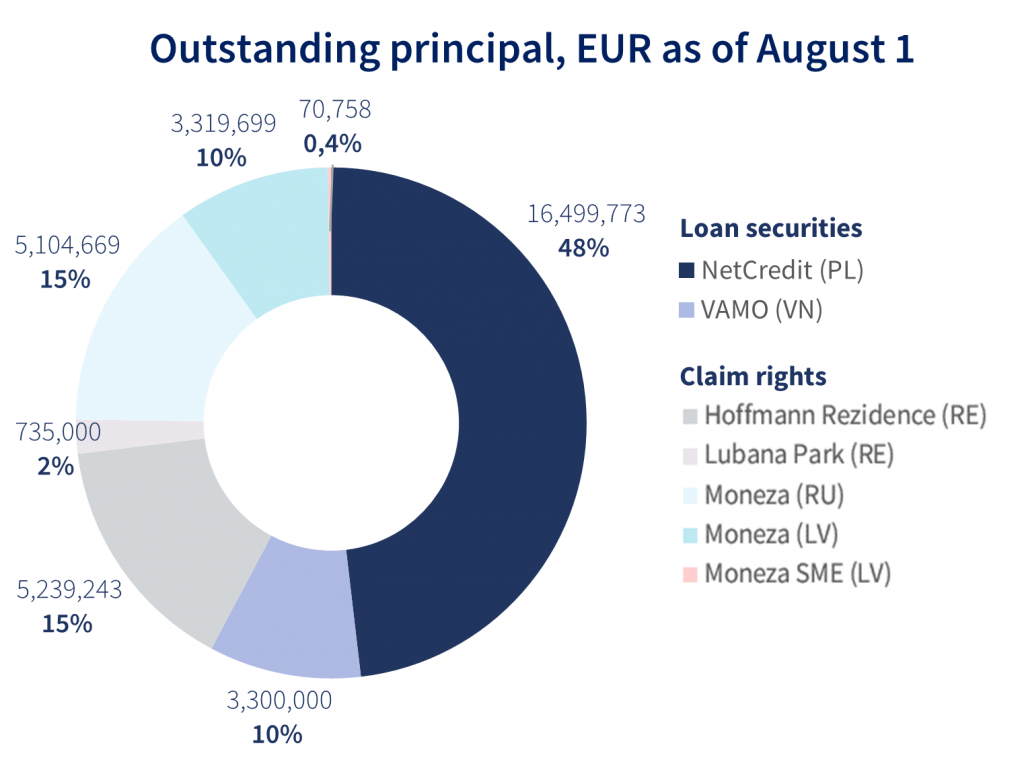

Key figures of July 2023:

Investments in rental properties now available on TWINO. Last week we launched a new product – Real estate securities (RE Securities). These are equity-based financial instruments offering investments in short-term rental properties. The new product enables private investors to purchase a stock of a company that owns rental assets and works as follows:

- Investors purchase equity shares of a company (set up and managed by TWINO)

- The company further uses the funds to acquire a specific property (specified in the Prospectus)

- The company then generates rental income and profits from property appreciation over time

- Investors (as the shareholders of the company) receive dividends from the company

To celebrate the launch, we are offering a 5% Cashback bonus on any investment in RE Securities!

The main difference between RE Securities and other real estate investment products already on the market is that the investor does not lend money for the development of property (debt investment) but acquires ownership of a specific asset (equity investment). Similar to shares of listed companies on the stock exchange, profits are made in the form of dividends, not interest payments.

The innovation in investment tools opens up more opportunities for investors from all social and economic backgrounds to invest in asset classes that were previously available to few and were considered niche. Our new product provides the benefits of rental apartment ownership without the high capital requirements, time commitment, and challenges associated with real estate acquisition and management that have traditionally been a barrier to this type of investment from an investor perspective”,

says Helvijs Henšelis, Chief Executive Officer and Chairman of the Management Board of TWINO.

The new product offers you a genuinely passive investment experience as TWINO handles all aspects of property acquisition, renting, and daily management.

TWINO recognized as one of the world’s top fintech companies. We are proud to be included amongst this year’s CNBC and Statista’s World Top FinTech Companies 2023 in the category of Alternative Lending. The list compiles the top 200 fintech companies under nine categories developing innovative, tech-enabled, and finance-related products and services.

Non-bank lending remains to be a rising trend in the financial services industry with the global digital lending platform market expected growth to $46.5 billion by 2030. We are excited to drive this growth by building financial solutions that make it easy and reliable for people to achieve their financial goals and financial independence.

Find out more here.

Improvements in the platform’s functionality. Based on your feedback, we have introduced a new format for an income statement, which breaks down the income generated from various investment products and as such provides you with a more transparent view of your returns. You can view the new income statement in your TWINO profile, under the section “Reports”.

Affiliate program. We have re-launched our affiliate program on Circlewise to make it more compelling for affiliates to join our platform and receive rewards. If you are a partner looking for collaboration, please reach out to us.

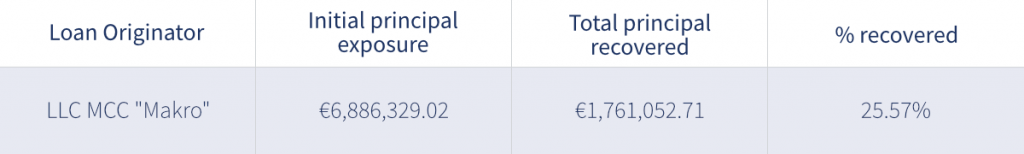

Update on Russian loans. Here’s the latest summary of war-affected loans:

As of today, over €1.7 million of war-affected loans have already been repaid.