At first glance, the Fintech sector seems to be among those industries that remain unscathed by the pandemic-induced economic crisis. With many areas of life moving to digital and remote formats, some studies report a staggering 72% rise in the use of Fintech apps in Europe.

But a more thorough analysis reveals that different areas of Fintech and companies at different stages have been unevenly impacted. There is a growing gap between well-established Fintech corporations and smaller, younger companies that find it more difficult now to find their place in the market and attract investment. This isn’t surprising since a quick reaction to the pandemic required capital and strong operational processes.

Let’s look at how the Fintech sector is faring in general, with a closer look at investments in various Fintech segments and companies.

Pandemic changing the Fintech funding scene

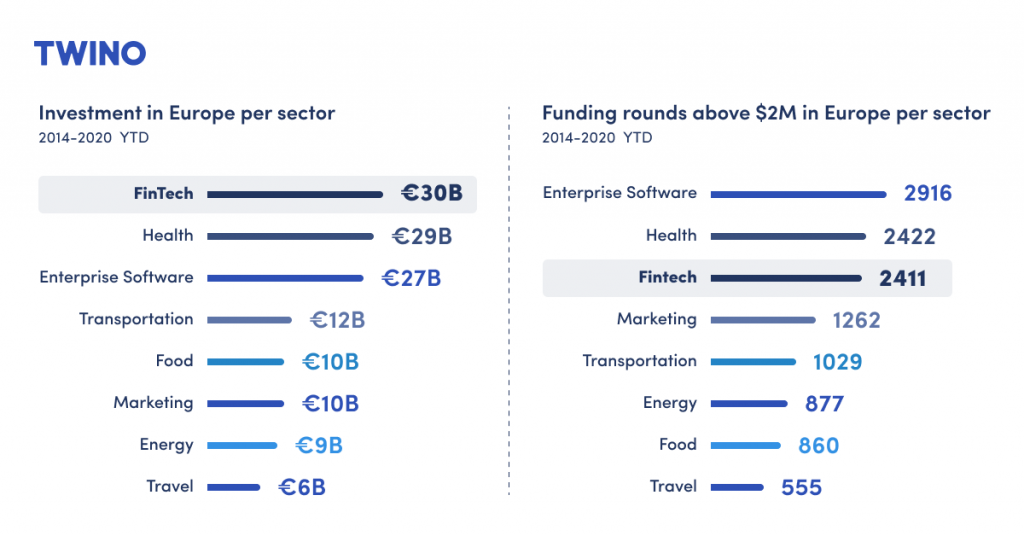

In 2019, before the world came to a halt due to COVID-19, experts predicted that Fintech investment would remain robust in Europe, with maturing players closing even larger financing rounds. After all, Fintech is Europe’s largest equity investment category, receiving more than €30B in venture capital investment since 2014.

Source: Dealroom.co

However, Fintech funding in 2020 turned out to be lower than expected, falling below 2019 levels (but still being higher than in 2018). Considering that COVID-19 has transitioned many aspects of work, shopping, and entertainment to remote and digital formats, we could have expected a steadier funding stream in 2020. It seems that the general doubt and uncertainty have impacted the investor’s sentiments too. Brexit might be another reason for this hesitation since London, the long-standing biggest Fintech investment hub, is now living through unclear times.

Matus Maar, the co-founder of the London-based venture capital investment firm Talis Capital, highlighted the changes in investor preferences last year: “Any new investments we considered in this time [in 2020] were companies that could demonstrate how they had quickly adapted – and could take advantage of – the new market conditions.”

A growing divide between established and young companies

The pandemic hit Fintech companies at different development stages, letting some cope with the crisis better than others.

Companies with an established position in the market have adapted to the pandemic with relative ease. These well-rooted companies are tech-savvy, adaptable, and confident in their operations. TWINO is an example of a company that didn’t feel a significant negative impact from the pandemic – in fact, during the second COVID-19 wave, the absolute majority of investors continued investing, and the company’s financials and reputation were growing.

For established Fintech companies, the crisis is a time to show good business results and even plan expansion. At TWINO Group we have prioritized the development of our investment platform and obtaining an investment brokerage license. Companies can also work on improving their image as employers who haven’t taken any negative decisions concerning employees.

The majority of Young Fintech startups that were in a development stage when COVID-19 hit and hadn’t yet entered the market have paused their operations and are seeking new investments. More successful startups have found additional funding and await the best moment to start entering the market.

Traditional financial service companies that had started their digital transformation before the pandemic, but didn’t manage to complete it, are now in a tight spot. Such companies continue feeling the effects of the crisis. For example, those that hadn’t fully implemented online client onboarding and verification are now facing problems.

These observations are reinforced by The State of Fintech in Europe 2021 report that provides a deeper insight into the Fintech industry’s funding in recent years. We can see that significant growth in Europe has been driven mainly by Fintech companies raising growth funding (+€15 million rounds) and late-stage financing deals of €100 million or more. The number of early-stage funding rounds (less than €15 million) effectively decreased during the three full years analyzed in this report.

This shows us an interesting trend – stronger and well-established companies continue to attract funding again and again. Meanwhile, low Initial public offering (IPO) activity might indicate that investors are cautious about not getting sufficient public valuation.

In the list of top-funded European Fintech companies, the majority is consistently posting losses year after year, which together with lack of exits and public listings leads to a question – are the funds financing these companies still hoping business models without clear revenue generation mechanisms will be turned around, or are they consciously fuelling the bubble reluctant to record losses?

Fintech after Brexit

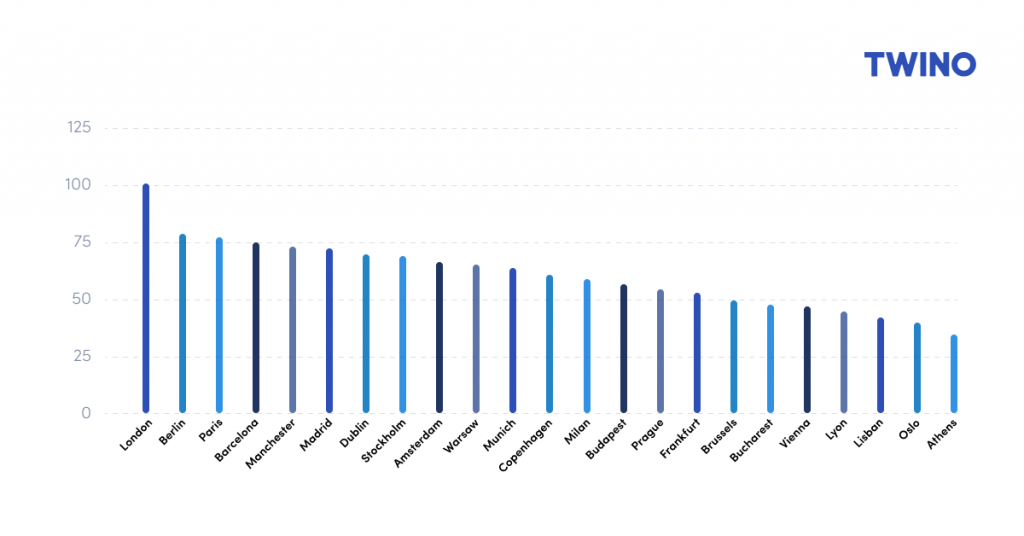

We can’t underestimate the impact of Brexit on the state of Fintech in Europe. Until now, all the major Fintech deals have been happening in the UK. This chart shows the most attractive cities for Fintech companies in Europe in 2020:

Source: Statista

Who will take over London’s role as the European Fintech leader – will it be Berlin or Paris, or some new underdog location? Or, will the UK manage to keep its leading position despite Brexit? Many think this is an unlikely scenario, while others point out that the UK’s departure from the bloc will give it the freedom to spur innovation and forge its own regulatory path in Fintech and cryptocurrency. In this scenario, the UK might be able to reinvent itself as a hub for decentralized finance and crypto.

Optimistic outlook for Fintech

Statista Market Forecast states that the European Fintech market will continue to grow for the next five years, with Digital Payments remaining its largest segment. The Alternative Lending segment will also continue to grow, reaching a total transaction value of US$ 10.636m in 2025. The biggest predicted transaction value growth (9.4%) is predicted to happen this year, after a slightly negative growth indicator (-2.2%) that the industry saw in 2020.

Source: Statista

As we are living through these historical times that are presenting us with equal challenges and opportunities, it’s worth remembering that a generation of world-leading Fintech startups and scaleups were born during the last financial crisis, including Stripe, Transferwise, and indirectly, Revolut.

The agile and flexible business models of Fintech companies allow for innovation and flexibility, enabling them to respond to changing demands and take advantage of new opportunities at speed and scale.