To measure investor satisfaction and determine what TWINO lenders think about our features and the company’s overall progress, we recently carried out an investor survey. We are pleased to see that the investors’ high evaluation would put us on Santa’s Nice List this year. Several areas for improvement have been identified, promising a bustling new year full of great opportunities and important achievements.

Meet the TWINO investor – an experienced lender with a diverse portfolio

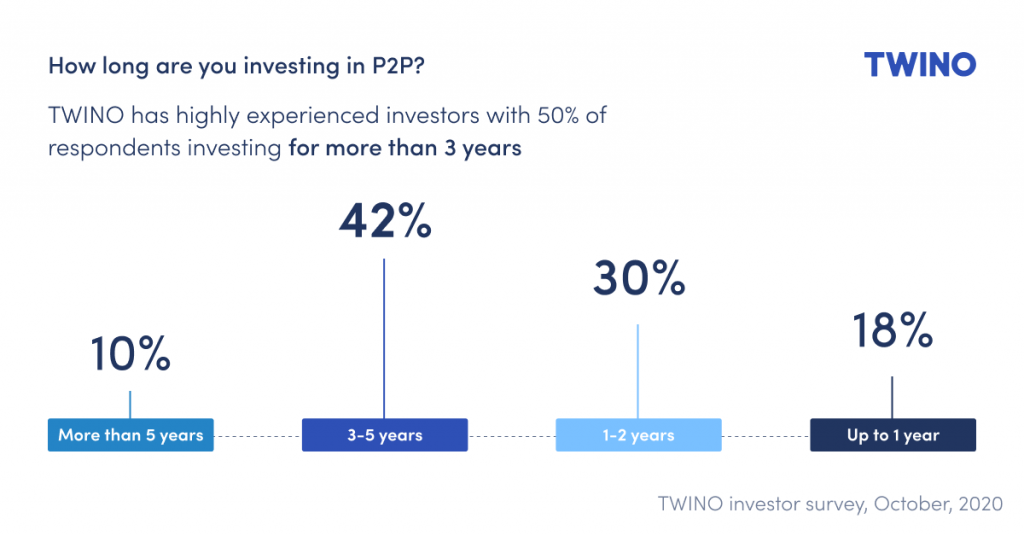

We are happy to see highly experienced investors among our ranks, urging us to strive to achieve our best continuously. Around half of the TWINO survey respondents are mature investors contributing to the P2P lending sector for three to five years (42%) or even more than five years (10%).

The surveyed investors are aware of different investment opportunities and diversify their portfolios by investing in different asset classes. Besides P2P, the surveyed investors work with other asset classes, namely stocks (64%), Exchange Traded Funds or ETFs (54%), savings accounts in banks (47%), and real estate crowdfunding (41%). Other investment opportunities chosen by the survey respondents are cryptocurrencies, real estate (not crowdfunding), bonds, and others.

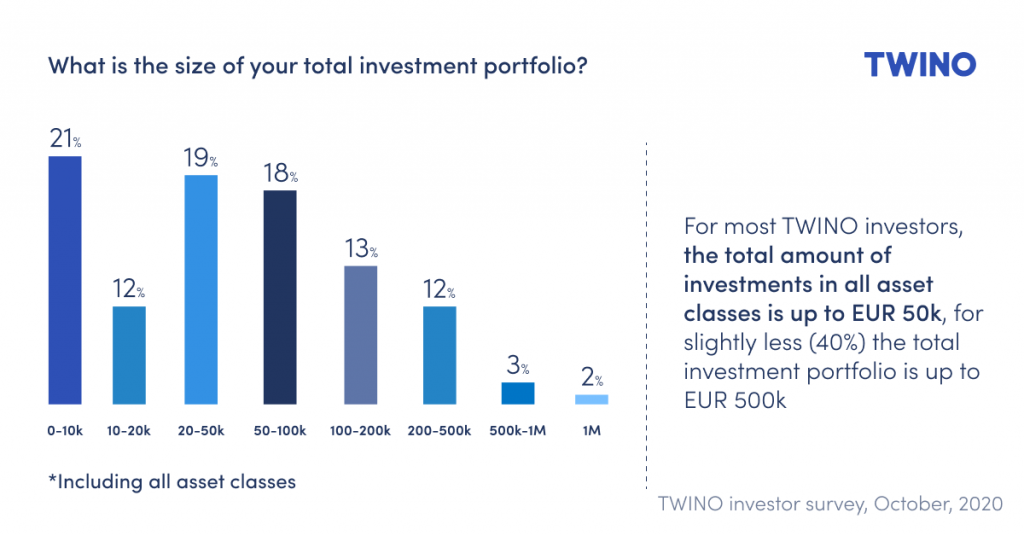

Investors also contribute to other P2P lending platforms, Mintos (72%) and Bandora (46%) being the most popular. 21% of TWINO lenders reveal that their total portfolio size is up to EUR 10K; similar shares of respondents have portfolios of EUR 20-50K (19%) or 50-100K (18%).

What investors like most about TWINO

While more than 80% of our investors are satisfied or totally satisfied with TWINO’s investment product offer, 16% would like to see higher returns, and 10% want us to be even more transparent.

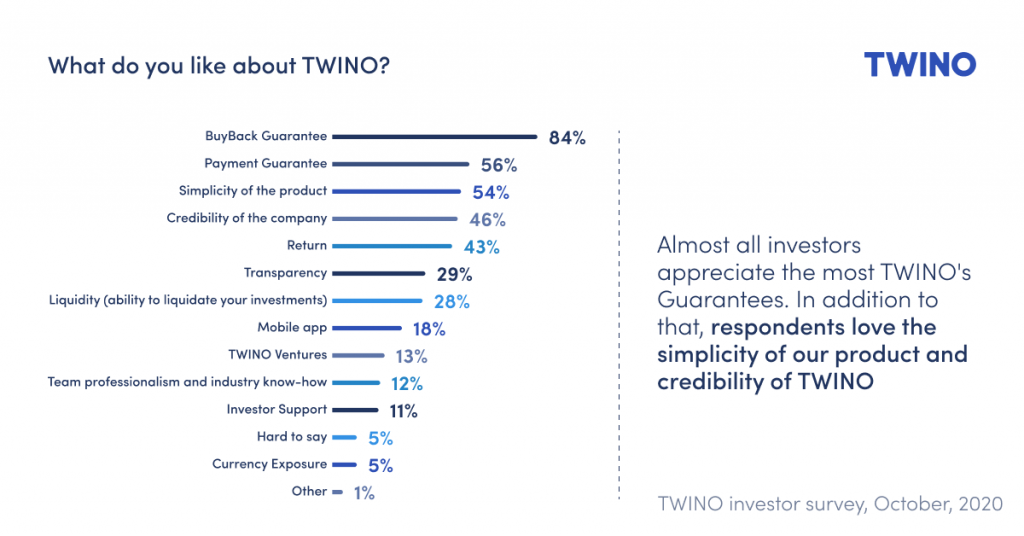

A majority of our investors appreciate TWINO’s Guarantees like BuyBack and Payment Guarantee. In addition to that, respondents love the simplicity of our product and the credibility of TWINO, as well as many other features and characteristics of our platform. We are delighted to see such a high appreciation for TWINO’s services, especially from investors who are well familiar with the P2P lending industry.

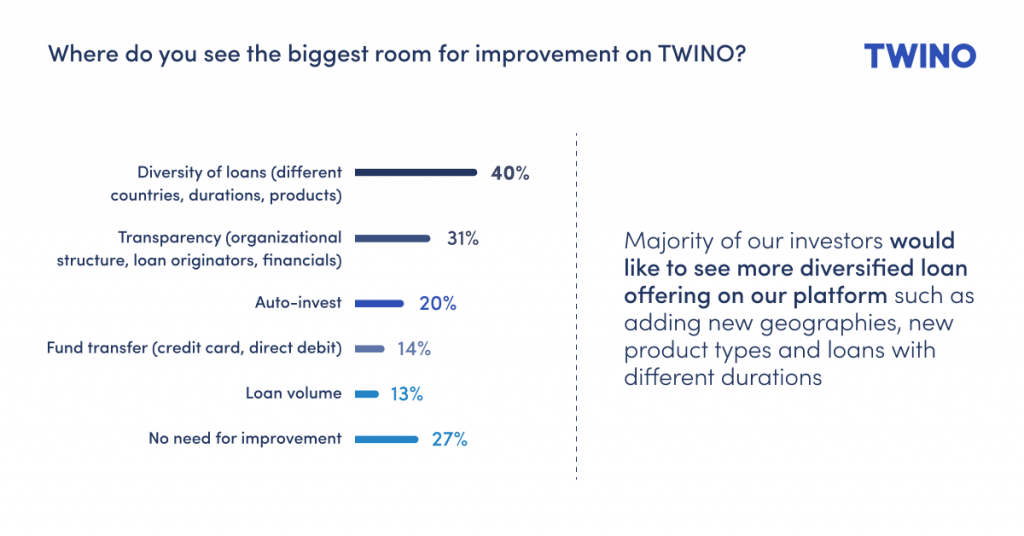

Nobody’s perfect, so we asked investors how we could improve our service. Besides the suggestion to diversify our loans, TWINO investors would like to see even more organizational transparency.

Investors also suggest that new features be added like loan originator and country statistics, more filters for manual investments, automatic withdrawals and multi-currency investor accounts.

Most respondents would recommend TWINO as a great investment opportunity – 45% would do this likely, and 27% even very likely.

COVID-19: Keep calm and keep investing

We are thankful to our investors, whose maturity and ability to make informed decisions are among the main reasons why TWINO is able to cope with the impacts of COVID-19 successfully.

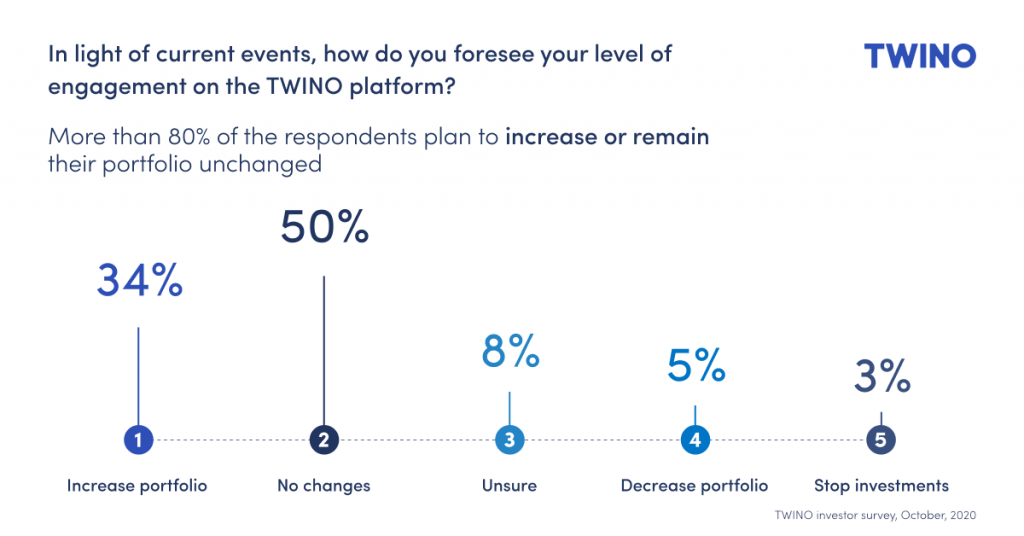

Our investor survey shows that currently, more than 80% of TWINO P2P investors are confident in the way they are managing their investments, planning to increase their portfolio, or keep it unchanged.

During the first COVID-19 outbreak in spring, 40% of respondents postponed their investments in the platform. While 12% did this to diversify their investment portfolio, almost 70% were worried about general economic consequences and uncertainty.

However, during the second wave of COVID-19, we no longer see this tendency. In addition, the absolute majority (95%) of our investors agree that TWINO has a solid contingency plan in place to respond to market conditions created by the COVID-19 pandemic.

TWINO’s positive business results against the backdrop of a pandemic are consistent with the overall success of global FinTech companies this year. Despite the global crisis, FinTech businesses have reported an increase in their transaction numbers (13%) and volumes (11%) in the first six months of 2020. This goes hand in hand with reported improvements in other key market performance indicators such as new customer acquisition and customer retention.

New Year’s resolutions for TWINO and the P2P industry

We at TWINO continuously strive to improve our services and always look for ways to contribute to the P2P lending industry. We are happy to see that almost all top players in the Latvian P2P lending market are presently going through the licensing process.

We are also pleased that the Financial Capital Market Commission (FCMC) is forthcoming and willing to help the companies become more compliant. This is a positive signal that the P2P lending sector is becoming more organized and regulated.

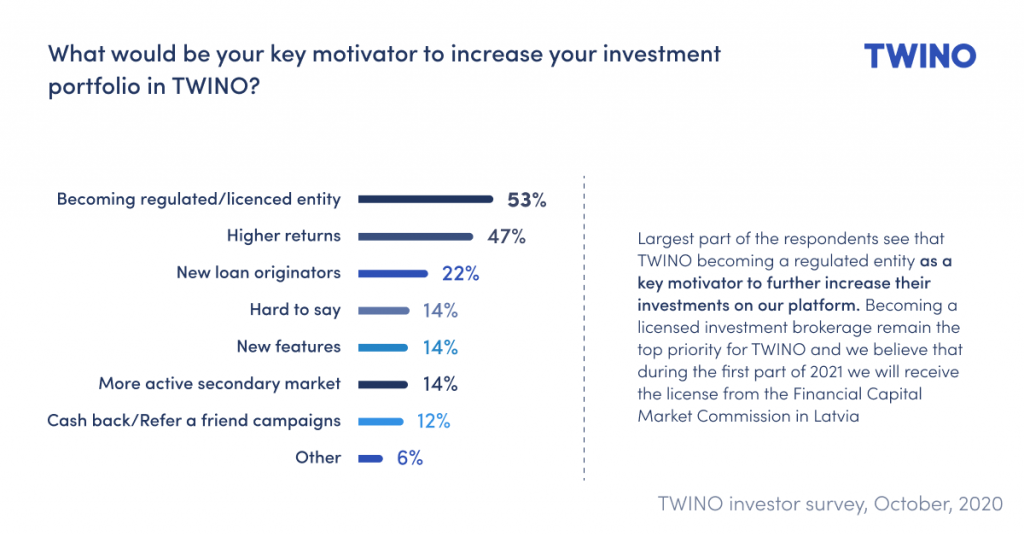

The largest part of the respondents (53%) acknowledge that TWINO becoming a regulated entity is a crucial motivator for further increasing their investments on our platform.

Becoming a licensed investment brokerage remains our top priority, and we are actively working toward it. Among other processes and new features, we are working to adjust our product for the regulated environment that would open a wider choice of assets for our investors to contribute.

We are looking forward to receiving the Financial Capital Market Commission (FCMC) license in the first part of 2021. Meanwhile, we are working on improving our organizational structure, strengthening our team competencies, and, of course – implementing some of the features suggested by our investors. This is our Christmas gift to you. And the best gift you could ever give us is your continued trust in our platform!