Not only have stock markets and financial services taken a hit by the outbreak of COVID-19, but the peer-to-peer (P2P) lending sector has as well. Seven months into the pandemic is enough time to analyze our numbers and evaluate how TWINO has coped with the global crisis.

We have already talked about how we reacted to the Covid-19 outbreak by adjusting our internal operations and moving all employees to the remote work model. In this article, I will be looking at TWINO’s business results during the past seven months.

Overall, we have survived this time without much damage and even with moderate growth. I believe that our relative success has been due to several factors:

- Transparent and proactive communication. I believe that our focus on honest and clear communication has been the key to maintaining strong investor confidence.

- Quickly adjusting internal operations. As an online-first company, we’ve always served clients online and let employees work from home. These factors proved hugely beneficial when the clients could easily access our services anywhere and anytime.

- Strong internal product analytics. This helped us make smart and timely data-driven decisions.

Now I’ll share some of that data with you, supplementing it with my observations about the latest trends in the P2P lending sector.

Investor activity

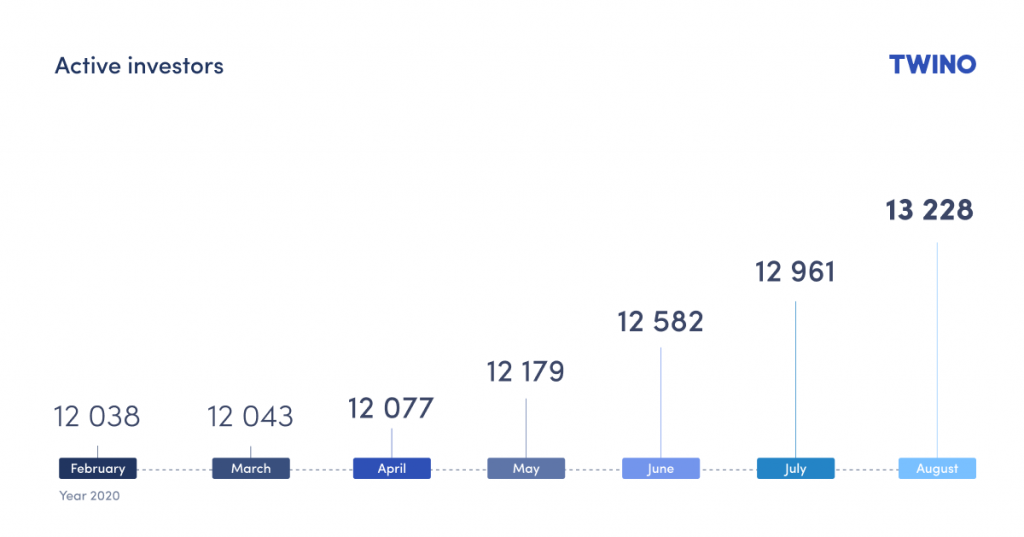

TWINO, like most lending platforms around the world, started feeling the impact of the pandemic in March and April. Interestingly, the number of active investors (those with funds on their investor profile) remained unchanged during the first months of the COVID-19 outbreak. It seems that many investors pressed “Pause” for taking big steps in any direction – like withdrawing their funds or making new investments.

As you can see in the chart below, in May, the number of active investors started to grow and has continued to do so since then. We also saw that only a part of the investors reduced their portfolios during this time, and only a few withdrew their funds altogether.

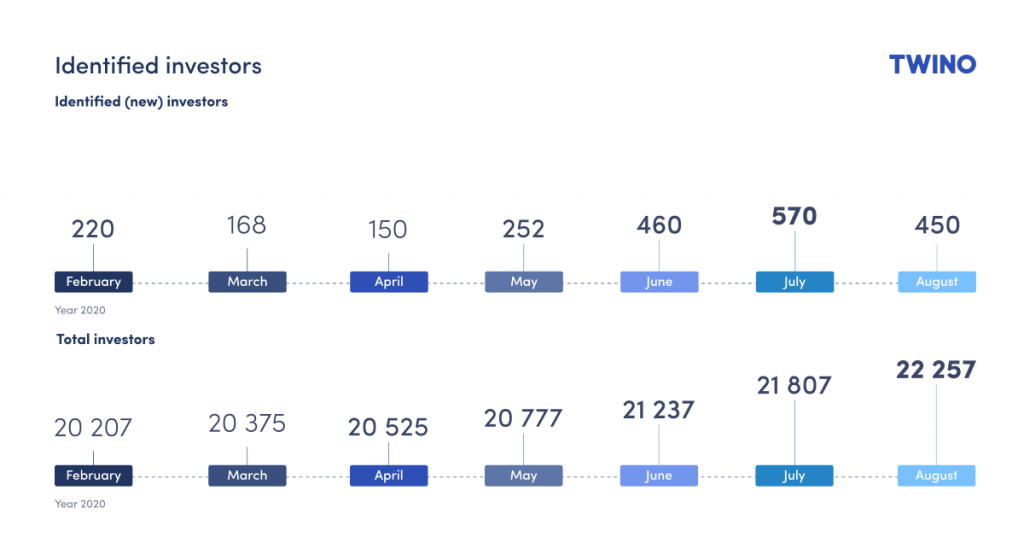

Meanwhile, new investors continued to join the platform. As you can see in the graph below, the number of new investors continued to grow, albeit slowly, even during the most critical months. During the first eight months of this year, our total investor count has increased by more than 10%.

During these turbulent times, we made a considerable effort to make investments in the TWINO platform as attractive as possible, and it resulted in steadily growing new investor numbers. In terms of new investors onboarded, July was our best month since April 2017 and the 4th best month ever.

Investment volumes

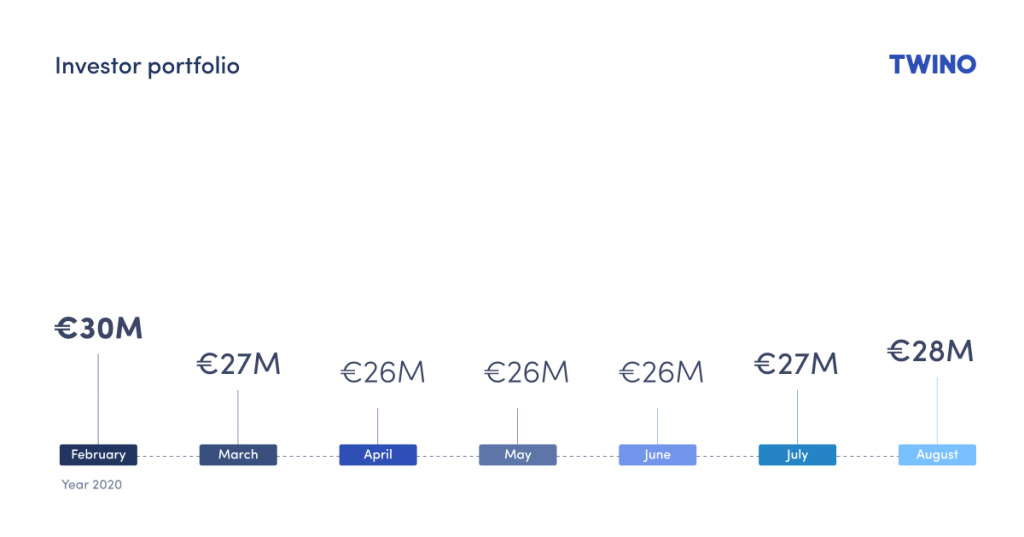

After a promising start of the year, in March and April investor cash-flow showed a negative trend. But already in May and June, we started seeing positive trends in this regard.

With new investors coming in, TWINO’s investment portfolio has almost returned to pre-COVID-19 levels. Currently, we are only 5% away from February’s investment level.

The funded loan volumes suffered a significant drop in April and May, with only 6 and 7 million subsidized loans via the TWINO Investment platform. June showed an increase with 10 million funded. This chart shows that the volume of loans financed in July has nearly reached pre-COVID-19 levels.

This matches the tendencies exhibited by international P2P Lending data. After a promising month of February, the European P2P lending sector saw an evident decline in lending volumes, with April being the least profitable month for most lending platforms. Most P2P lending providers in Europe suffered significant losses compared to the previous month and even more compared to the same month last year.

In May and June, the P2P lending market started to recuperate while still the majority of companies had much lower revenue than in the same period last year. In July and August, companies recovered with varying success – some came back to pre-COVID levels while others struggled to maintain a positive balance. These differences could be attributed to the uneven spread of COVID-19 in countries across the world.

Let’s have a better look at how the COVID-19 pandemic has influenced investor mood across Europe.

P2P lending market recovery country by country

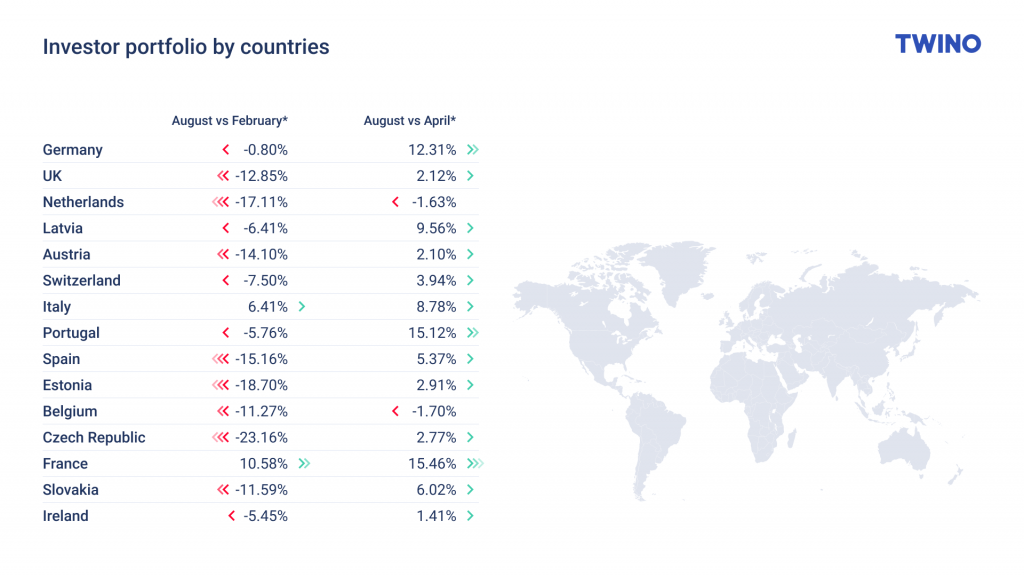

When we look at investor portfolios by country, two comparisons help us analyze the P2P sector’s performance – August vs. February (now vs. pre-COVID performance) and August vs. April (now vs. the worst lockdown month). The graph below shows European countries listed by portfolio size, with Germany as the biggest portfolio holder.

You can see that, for example, the number of German investors in August had returned to pre-COVID levels, which is a surprisingly quick recovery. Since reaching the lowest point in April, the German investment portfolio has grown by 12.31%.

Germany’s deeply-rooted P2P lending traditions could explain such a quick comeback. German investors are educated and often experienced in peer-to-peer lending and therefore are more likely to take well-considered actions rather than make rash decisions. Also, they may have seen the recovery trends of the P2P lending sector sooner than others.

Meanwhile, investors from other countries like the Czech Republic, Estonia, and Spain have reduced their investments significantly compared to pre-COVID times and have recorded less than 5% growth in investor portfolios since April. This might indicate that investors from these countries are cautious about making investments in times of global uncertainty. One of the main concerns could be that borrowers may be earning less during the pandemic, affecting their ability to pay back their loans. Hopefully, we will see a return of funds from these countries when the global epidemiological situation steadily improves.

Finally, Portuguese and French investors show the quickest return of confidence – they are investing around 15% more than they were during the worst lockdown month.

What’s in the cards for the P2P sector?

The P2P lending industry has adapted to the challenges of the COVID-19 pandemic rather quickly. While not all P2P lending platforms are faring equally well in these trying times, TWINO has been left relatively unscathed due to our flexible and transparent operations.

As many countries take tentative steps towards exiting full lockdown conditions, I will cautiously share my vision for the future of the P2P lending industry:

- P2P lending will become increasingly regulated, giving more security and confidence to investors;

- The biggest lending platforms will further increase their market share, with investors prioritizing investments’ security and transparency over higher returns;

- The leading P2P lending providers will challenge more traditional investment services that focus on stocks, ETFs, or CFDs by becoming more regulated and increasing investor confidence in the industry.

It’s also possible that investor average returns might go slightly lower compared to the levels we have seen during the last few years. However, that will be justified by significantly larger scrutiny towards loan originators, which of course will increase the overall investment offering quality.

It’s also possible that higher numbers of borrowers seeking loans will drive up the traditional lenders’ interest rates. It may, in turn, encourage many borrowers to consider alternative lending services such as P2P platforms.

Due to all these factors, we are cautiously optimistic that the P2P lending market is slowly but surely working towards recovery and will soon see growth opportunities.